WordPress allows you to enable user registration to add posts, comment, or perform other actions on your website.

It comes with a built-in functionality to manage user registrations from the admin section of your dashboard. By default, it is turned off, but you can easily turn it on if you want member registration on your website.

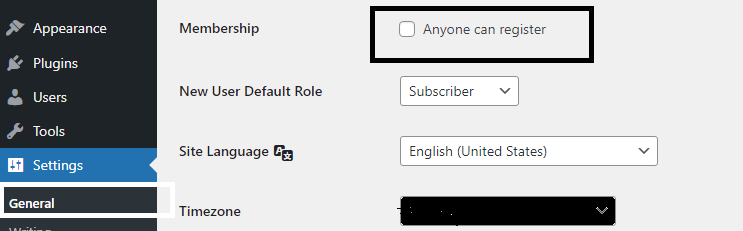

In your wordpress Dashboard, go to Settings » General page, then scroll down to the ‘Membership’ section and check the box next to ‘Anyone can register’ option to enable members registration in your site.

Don’t forget to add a default user role in the next available option “New user default role”. This default role will be assigned to a new member when they register into your site.

You are suggested not to use ‘Administrator’ as the default user role for user registrations. If you select ‘Administrator’ as the new user default role, then anyone can take over your website as he/she will have complete control on your site’s dashboard/admin section.

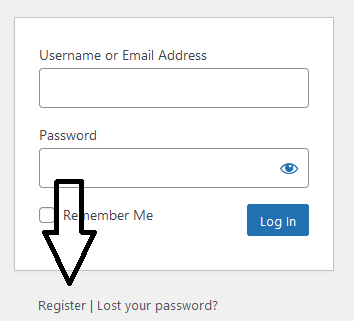

If you select the ‘Anyone can register’ option, then your website is open to user registration. You can visit your site login page to find the option to register as a new user.

You are required to create a registration page and assign it as a default to your website.

You can have the log in and log out option in your sidebar by using meta widget in your wordpress widget section.

You have paid and free plugins available to build registration and login pages for your wordpress site.

You can also try the “buddypress” plugin for a membership site.