GST is a destination based tax levied on every value addition. GST has subsumed almost all the indirect taxes in India. Registration under GST law is the first and foremost thing every business man does to get started. Registration recognizes a person as a supplier of goods or services or both.

After GST registration, your business will be assigned a GSTIN, which is essentially a tax number assigned by the government of India. After having GSTIN, you need to show it on all invoices, name plate and other legal documents. Registration under GST will let you pass on the input tax credit to recipient of goods.

After getting GSTIN for your business, you can collect taxes from your customer and pass on the credit of the taxes paid on the goods or services supplied to the purchaser or recipients.

In this article, we will discuss;

- When GST registration is mandatory?,

- What are the documents required?, and

- When to get your business registered under goods and services tax?

Who should register for GST ?

GST registration in India is compulsory when a person undertakes a transaction amounting to supply and their turnover in a financial year crosses the threshold limit.

Without a GST registration, no one can collect taxes on behalf of the Government and avail input tax credit for gst paid on inward supplies. Therefore, if your turnover is below the threshold limit as specified by the Government and you want to take benefits of input tax credit, then you can opt for voluntary registration.

In case of voluntary registration, you will be treated at par with a registered person and you need to comply with all the provisions of GST law.

Threshold limit is species based on the state or union territory from where the person makes a taxable supply of goods or services or both.

As per GST law, every supplier shall be liable to be registered under the GST law in the state or union territory from where he makes a taxable supply of goods or services or both if his aggregate turnover in a financial year exceeds the threshold limit.

| Type of supply | Threshold limit of aggregate turnover in case of special category of states (Manipur, Mizoram, Nagaland and Tripura) | Threshold limit of aggregate turnover in case of all other states |

| Goods | Amount not exceeding 20,00,000, if opted by the special category states | Amount not exceeding 40,00,000, if opted by the States |

| Serves / Goods and Services | Amount not exceeding 20,00,000, if opted by the special category states | 20,00,000 |

With effect from 1st february 2019, special category of states are Manipur, Mizoram, Nagaland and Tripura.

How to calculate aggregate turnover?

Aggregate turnover = taxable supplies + exempt supplies + export supplies + inter-state supplies of persons having same income tax PAN

However aggregate turnover excludes inward supplies liable to reverse charge mechanism, CGST, SGST, UTGST, IGST and Cess.

Who are not liable for registration under GST

As per section 23 of the CGST Act, 2017, following persons are not liable to be registered under GST:

- any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax;

- agriculturists who supply produce cultivated out of his land; and

- persons notified who are exempted from obtaining registration by way of notification

Where should you register your business

All eligible persons are required to get registered under GST law in the state or union territory from where he makes a supply. If supply is from different states or union territories, then separate registration from such states or union territories is required.

This means if you are established in Odisha and supply is from Odisha state, then you have to get your business registered in Odisha. You have to get it registered only when you are liable to register as per GST law.

If your business entity has branches in multiple states and supply goods from there, then you have to take separate registration in each state. In case within a state you have multiple business verticals, then you can avail multiple registration for each verticals.

Example: A dealer has three offices – one is in Bangalore and the other two are in Delhi. In order to find out whether the dealer is liable for GST registration, you need to add turnover of all the three offices. If total aggregate turnover exceeds the threshold limit, then the dealer is liable for registration under GST.

What is voluntary registration under GST law ?

A person who is not liable to be registered under GST can get registered voluntarily. Such a person has to follow the same process of registration.

Once registered, such a person will be liable to charge GST and must pay it to the government regularly. After obtaining voluntary registration, such a person must pay tax even if annual aggregate turnover for the year is less than the threshold limit.

While applying for registration, you need to select voluntary registration in the application form.

Is GST registration free?

Yes, you need not pay any fee while registering for a goods and services tax number. However, professional fee for helping you to get registration can be levied if you are taking the help of any chartered accountant or advocate or other finance professional.

What are the documents required for GST registration?

Document requirements depend on the form of business that you register in India. Here is a list of documents that are generally required for registration under GST;

- Income tax PAN of the applicant

- Photographs of proprietor, partner, trustees, CEO etc

- Any governement registration certificate

- Proof of address of principal place of business – rent agreement, ownership document, electricity bill or property tax receipts.

- Bank statement, cancelled cheque

- Authorization letter (In case of company board resolution required)

- Digital signature certificate (DSC)

- Identity and Address proof of promoters/directors with photograph

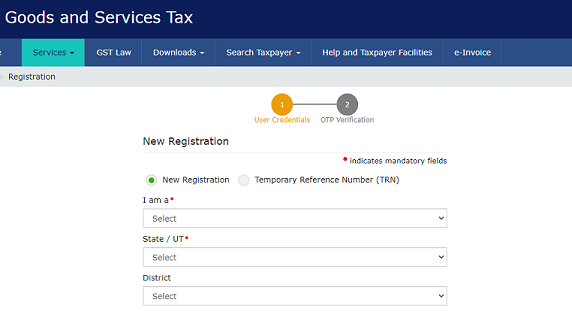

GST registration is online. You can submit your details through gst.gov.in and upload all required documents with details to get yourself registered.

After registration, every registered person shall display the certificate of registration in a prominent location at his principal place of business and every additional place or places of business. You are also required to display your GSTIN on the name board exhibited at the entry of his principal place of business and at every additional lace or places of business.

Why Income tax PAN is mandatory to get registered under GST law?

In India, GST registration is PAN based. This means, to obtain GST registration, you first have to obtain income tax permanent account number or PAN.

If you want multiple registrations in different states or Union territories, then it has to be obtained under the same PAN.

As per section 25(6) of CGST Act, 2017, every person shall have a permanent account number or PAN issued under the income tax act, 1961 in order to be eligible for grant of registration. If you are liable to deduct tax under section 51 of CGST Act, 2017, then in lieu of a permanent account number, a tax deduction and collection account number has to be issued first.

However a non-resident taxable person may be granted registration on the basis of such other document as may be prescribed. This means for a non-resident PAN is not mandatory. Non-resident has to submit a self-attested copy of his valid passport along with the application signed by his authorized signatory who is an Indian resident having valid PAN.

You also have to note that, GST registration is not tax specific. This means one registration is required for CGST, SGST, UTGST, IGST and compensation cess. You are not required to take separate registration for each of these taxes or Act.

If a person is carrying business or profession with places of business in different states across India has one branch in a special category state, the threshold limit for GST registration will be reduced to Rs 10 lakhs.

A supplier is not liable to obtain GST registration from the state or union territories from where exempt or non-taxable supplies are made. This means, a person is required to obtain GST registration only with respect to place of business from where taxable supply has taken place.

Also Read: