You can cancel GST registration online if after taking GSTIN, you came to know that goods and services tax act is not applicable to you or you are closing your business. Cancellation will mean that goods and services tax provisions are not applicable and your business will not be liable to pay or collect GST in India. Before applying for cancellation of GST number, its suggested to know the provisions first.

In this article, we will be discussing when and how GST registration gets cancelled in India and what are its consequences.

As per goods and services tax law, following persons can apply to cancel GST registration in India;

- Taxpayer

- GST officer

- Legal heir incase of owner’s death

Here are certain situations where cancellation of GST number is a must;

- As per the law, every person registered under the old law are required to compulsorily migrate to GST law as a registered taxpayer. As per old VAT law of the state, compulsory registration limit was very less in comparison to the limit that is set in GST law. In such a case, a taxpayer can submit an application electronically from the common portal of GST to cancel the registration if goods and services tax act is not applicable.

- Taxpayer has voluntarily taken registration with expectation that GST registration will be mandatory as turnover for the year is expected to cross Rs 40 lakhs/20 lakhs/10 Lakhs as the case may be. However, it did not happen and taxpayer has decided to cancel the GST registration. This means ceased to be liable to pay tax.

- Taxpayer has closed down business.

- Change in constitution of business leading to change in income tax PAN.

- Transfer of business on account of amalgamation or merger etc.

- Death of sole propietor.

In case you have decided to cancel GST registration, then as per law it can be processed only by logging into the common GST portal.

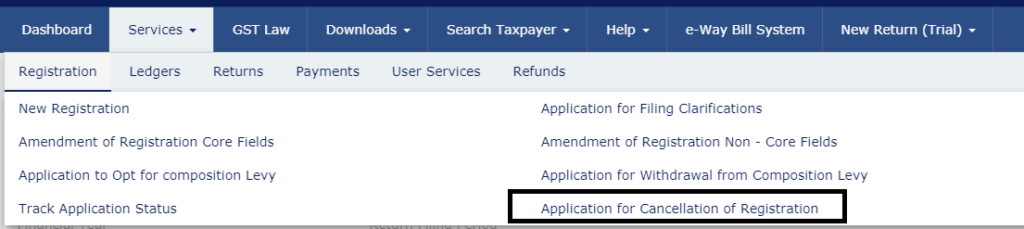

You can find the tab under the head services > registration > application for cancellation of registrations

After clicking this option, you will have three tabs to fill up your details;

- Basic details

- Cancellation details

- Verification

It’s very simple to fill up details under these tabs. If you are finding any problems then use our comment section below to ask us questions.

While applying, the only thing you need to keep in mind is the “Date from which registration is to be cancelled”. Please make sure that you have cleared your statutory dues and filed all the returns for all relevant periods. If not filed, then the first file it and then apply for cancellation of GST registration.

Cancellation of GST registration by tax officer

Registration number can also be cancelled by the GST officer in the following cases;

- Taxpayer do not conduct any business from the principal place of business

- Issue invoices without supply of goods or services

- Violation of GST provisions

If the GST officer has decided to cancel the registration number of taxpayers, then before such cancellation a show cause notice to such person must be sent in the prescribed form.

After receiving the show cause notice, taxpayer must reply to it within 7 days stating why his registration should not be cancelled. If such reply is found to be satisfactory, then the officer may drop the proceedings and pass an order. If such officer is not satisfied, then order will be issued within 30 days cancelling the registration number. 30 days will be considered from the date of reply to the show cause notice.

How to revoke cancellation of GST number

If GST registration number has been cancelled by the officer on his own, then the taxpayer can apply for revocation of such cancellation within 30 days from the date of the cancellation order.

After receiving the application, if the officer is satisfied then he can revoke the cancellation of registration by an order within 30 days from the date of receipt of the application.

If the officer is not satisfied, then he can reject the application and communicate the same to the taxpayer. However, before such rejection he must give an opportunity to the taxpayer to show why the application should not get rejected. In such a case, taxpayers need to reply within 7 days from the date of receiving the notice.

After receiving clarification from the assessee, such officer needs to take a decision on it within 30 days from the date of receiving a reply from taxpayer.

After cancellation, the business is liable to pay all the dues and taxes collected prior to cancellation. Please note, cancellation of GST number does not mean that you need to close down your business. You can continue your business even after cancellation if you are not applicable to pay GST on the supply of goods or services.

Final return to be filed in form GSTR-10

As per section 45 read with rule 81 of CGST Act, every registered person who is required to furnish return under section 39(1) and whose registration has been surrendered or cancelled shall file a final return in form GSTR-10 electronically through the common portal. Such return has to be filed within 3 months of the date of cancellation or date of order of cancellation, whichever is later.