Buying and selling of currency pairs in the foreign exchange market is known as forex trading. It’s a market where currencies are traded.

The word “Forex” is coined from a combination of the two words i.e. “foreign” and “exchange”.

Forex is also known as FX.

Forex trading is generally conducted over a foreign exchange trading platform. No physical building exists as a trading venue.

Forex market is a global network of computers and brokers which operate 24 hours (meaning it does not close overnight) and 6 days a week (From 5:00 pm ET Sunday through 5:00 pm ET on Friday).

Forex market has 4 time zones: London, New York, Sydney, and Tokyo. At any point of time at least one market is always open. When New York closes, Sydney opens.

The Forex market has two levels, one is the interbank market where large banks trade currencies and the other one is the Over-the-counter (OTC) market where individuals trade through online trading platforms.

A retail trader uses an online trading platform to trade in the Over-the-Counter markets. It’s also referred to as the spot market.

Spot forex is a leveraged trading account which allows retail traders to trade in currencies. In it, you are actually not trading in currency itself, rather you are trading in a contract.

For instance, if you are trading USD/INR, you are not going to take delivery of any Indian rupees. This is because you are buying USD and selling INR as a part of the currency pair contract. Therefore, no actual delivery is required. After closing your trade, you will get the profit or loss to your trading account.

The forex traders are settled in cash as the transaction involves simultaneous buying and selling of currencies.

A forex trader is basically speculating on the price movements of one currency against another with an objective to make profit.

Two biggest drawbacks of the forex market is lack of regulations which increases counter party risk and high leverage. The leverage allowed is around 20-30 times.

Why do many traders around the world prefer forex trading?

Forex or foreign exchange market is one of the world’s largest and most liquid markets. It is bigger than the US stock market.

As per report published by the Bank for International Settlements (BIS), daily averages for forex trading in April 2022 reached 7.5 trillion USD (link).

Traders prefer the forex market for two main reasons; Liquidity and trade from anywhere.

What is a Currency Pair?

In the forex market, you will find market participants trading one currency against another, such as the US dollar against the Indian Rupees (USD/INR). This is called a currency pair.

It’s a standard practice to trade currencies as a pair.

Here are few popular currency pairs;

- EUR/USD – the euro vs the US dollar

- USD/JPY – the US dollar versus the Japanese yen

- GBP/USD – British pound sterling versus the US dollar

- USD/CHF – the US dollar versus the Swiss franc

- AUD/USD – the Australian dollar versus the US dollar

- USD/CAD – the US dollar versus the Canadian dollar

Quotation of two different currencies with the value of one currency being quoted against the other is known as a currency pair.

Here is the standard format of the currency pair;

Base currency / Quotation Currency = Value

Base currency is always fixed at 1 unit of currency.

Quotation currency refers to another currency which equates to 1 unit of the base currency.

Values is the value of the quotation currency against the base currency at that point of time.

For example let us assume USD/INR = 83.7501. Here in this case, the base currency is USD which is 1 unit of US dollar. Quotation currency is Indian Rupees (INR) and value is 83.7501.

Which means, 1 unit of USD is equivalent to 83.7501 INR. In simple terms, 1 USD = 83.7501 INR

If the price USD/INR increases, then it means one unit of USD can now buy more units of INR. When the value of the pair goes up, the base currency value goes up and the quotation currency value weakens.

Common Forex trading scams

Forex trading itself is not a scam.

But like in any other market, in forex, we have certain scammers who come in many forms, from unscrupulous brokers to fake trading systems.

Scammers pretending to be one of the best financial advisors or managers make promises of unrealistic returns with little or no risk. Scammers collect money from new investors with a promise of high return. Instead, they use their money for trading. If any investors ask for return of capital, then they use new investors money to pay off earlier investors. This type of scam is known as Ponzi scheme.

Certain entities are also offering forex trading service without proper licences and regulations. As a new investor or trader if you are not aware about these scammers, then you may lose all the deposits with them.

In many cases, scammers did not allow investors to withdraw their funds or refused to return funds.

If you are in India, make sure that you open your trading account with a SEBI registered broker and trade as per RBI’s guidelines.

If you are not from India, then make sure that you go by your own country’s rules and regulations.

Is Forex trading legal in India?

Forex trading is heavily regulated in India.

You can find misleading advertisements offering forex trading facilities to Indian residents on social media platforms, search engines, Over The Top (OTT) platforms, gaming apps and the like.

RBI has repeatedly advised not to conduct foreign exchange transactions on unauthorised electronic trading platforms or to send or deposit funds for this type of transactions.

As per RBI, a resident person is allowed to undertake forex transactions only with authorised persons and for permitted purposes in terms of the Foreign Exchange Management Act, 1999 (FEMA).

In India, forex trading platforms are banned.

Only permitted forex transactions are allowed to be executed only on approved electronic trading platforms (ETPs) or on recognized stock exchanges i.e. National Stock Exchange of India Ltd. (NSE), BSE Ltd. (BSE) and Metropolitan Stock Exchange of India Ltd. (MSE).

In India forex trading is regulated by SEBI. RBI, being the central bank of India, regulates forex transactions.

Foreign Exchange Management Act, 1999 (FEMA) does not allow a resident person to undertake forex transactions on unauthorised electronic trading platforms (ETPs). Penal action under FEMA may be initiated against a resident person who is undertaking forex transactions on unauthorised ETPs.

The list of RBI authorised electronic trading platforms (ETPs) is available here.

RBI doesn’t allow trading in foreign exchange unless it’s for a particular authorised purpose such as travelling abroad, education and export business.

Forex trading is legal in India. However, it’s highly regulated by RBI and SEBI. A resident Indian can only do permitted forex transactions with approved brokers, authorised dealers or with approved electronic trading platforms. SEBI controls forex brokers operating in India. Both RBI and SEBI allow approved forex brokers to offer trading on Indian stock exchanges like NSE, BSE and MCX.

Reserve Bank Of India (RBI) has issued the foreign exchange management (permissible capital account transactions) regulations, 2000 (link).

This regulation has specified transactions which are permissible to a person resident in India in Schedule I.

Schedule II has a list of permissible classes of transactions made by persons resident outside India.

RBI allows Indian retail traders to access the forex market through currency futures trading. It’s a regulated market that allows interested forex traders resident in India to trade currency futures contracts.

At present, currency futures trading is a small market compared to the global forex market.

National stock exchange (NSE) received approval from The Securities and Exchange Board of India, or SEBI in 2008 to offer forex trading in India through listed futures and options.

Three stock exchanges facilitate forex trading in India- NSE, BSE and Metropolitan Stock Exchange of India- jointly regulated by SEBI and RBI.

Currency trading in India is only allowed in 7 pairs- USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, and USD/JPY.

In Indian exchanges, currency derivative segment provides trading in derivative instruments like currency futures on 4 currency pairs:

- US Dollar – Indian Rupee (USDINR),

- Euro – Indian Rupee (EURINR),

- Japanese Yen – Indian Rupee (JPYINR),

- Pound Sterling – Indian Rupee (GBPINR).

It also allow cross-currency futures & options on following 3 currency pairs:

- Euro – US Dollar (EURUSD),

- Pound Sterling – US Dollar (GBPUSD), and

- US Dollar – Japanese Yen (USDJPY).

Brokers registered with SEBI offer exchange-traded currency derivatives in India. They don’t offer traditional forex trading (i.e. non-deliverable spot forex) due to the restrictions placed by RBI and SEBI for forex trading in India.

If you are thinking to use foreign broker to trade in forex, then go through this alert List of entities not authorised to deal in forex and to operate electronic trading platforms for forex transactions issued by RBI (link).

The alert list has names of entities which are neither authorised to deal in forex under the Foreign Exchange Management Act, 1999 (FEMA) nor authorised to operate electronic trading platform (ETP) for forex transactions under the Electronic Trading Platforms (Reserve Bank) Directions, 2018.

But, you can find misleading advertisements by these type of unauthorised entities offering forex trading facilities to Indian residents on social media and other platforms. RBI had cautioned the public not to undertake forex transactions on these unauthorised platforms.

Here is the alert list issued by RBI;

| Sr. No | Name | Website |

| 1 | Alpari | https://alpari.com |

| 2 | AnyFX | https://anyfx.in |

| 3 | AvaTrade | https://www.avatrade.com |

| 4 | Binomo | https://binomoidr.com/in |

| 5 | eToro | https://www.etoro.com |

| 6 | Exness | https://www.exness.com |

| 7 | Expert Option | https://expertoption.com |

| 8 | FBS | https://fbs.com |

| 9 | FinFxPro | https://finfxpro.com |

| 10 | Forex.com | https://www.forex.com |

| 11 | Forex4money | https://www.forex4money.com |

| 12 | Foxorex | https://foxorex.com |

| 13 | FTMO | https://ftmo.com/en |

| 14 | FVP Trade | https://fvpt-uk.com |

| 15 | FXPrimus | https://fxprimus.com |

| 16 | FX Street | https://www.fxstreet.com |

| 17 | FXCM | https://www.fxcm.com |

| 18 | FxNice | https://fx-nice.net |

| 19 | FXTM | https://www.forextime.com |

| 20 | HotForex | https://www.hotforex.com |

| 21 | ibell Markets | https://ibellmarkets.com |

| 22 | IC Markets | https://www.icmarkets.com |

| 23 | iFOREX | https://www.iforex.in |

| 24 | IG Markets | https://www.ig.com |

| 25 | IQ Option | https://iq-option.com |

| 26 | NTS Forex Trading | https://ntstradingrobot.com |

| 27 | OctaFX | https://octaindia.net |

| https://hi.octafx.com | ||

| https://www.octafx.com | ||

| 28 | Olymp Trade | https://olymptrade.com |

| 29 | TD Ameritrade | https://www.tdameritrade.com |

| 30 | TP Global FX | https://www.tpglobalfx.com |

| 31 | Trade Sight FX | https://tradesightfx.co.in |

| 32 | Urban Forex | https://www.urbanforex.com |

| 33 | XM | https://www.xm.com |

| 34 | XTB | https://www.xtb.com |

| 35 | Quotex | https://quotex.com |

| 36 | FX Western | https://www.fxwestern.com |

| 37 | Pocket Option | https://pocketoption.com |

| 38 | Tickmill | https://www.tickmill.com |

| 39 | Cabana Capitals | https://www.cabanacapitals.com |

| 40 | Vantage Markets | https://www.vantagemarkets.com |

| 41 | VT Markets | https://www.vtmarkets.com |

| 42 | Iron Fx | https://www.ironfx.com |

| 43 | Infinox | https://www.infinox.com |

| 44 | BD Swiss | https://global.bdswiss.com |

| 45 | FP Markets | https://www.fpmarkets.com |

| 46 | MetaTrader 4 | https://www.metatrader4.com |

| 47 | MetaTrader 5 | https://www.metatrader5.com |

| 48 | Pepperstone | https://pepperstone.com |

| 49 | QFX Markets | https://qfxmarkets.com/ |

| 50 | 2WinTrade | https://www.2wintrade.com/ |

| 51 | Guru Trade7 Limited | https://www.gurutrade7.com/ |

| 52 | Bric Trade | https://www.brictrade.com/ |

| 53 | Rubik Trade | https://www.rubiktrade.com/ |

| 54 | Dream Trade | Mobile Application |

| 55 | Mini Trade | Mobile Application |

| 56 | Trust Trade | Mobile Application |

RBI also states that, the Alert List published by them is not exhaustive and is purely based on what was known to the Reserve Bank of India (RBI) at the time of publication.

If an entity is not appearing in the Alert List, it should not be assumed to be authorised by the RBI.

Remember, forex trading in India is limited to exchange traded currency derivatives and futures.

How to verify SEBI authorisation for currency trading in India?

To know whether a broker is authorised by the SEBI or not, you need to check the registration number at the disclosure text at the bottom of the broker’s homepage.

Additionally, you can verify on SEBI’s website to validate that the broker is authorised. If you are interested in online forex trading in India, then make sure that the broker is registered with SEBI. Through these brokers you can trade in forex on recognised stock exchanges such as the Bombay Stock Exchange (BSE), National Stock Exchange (NSE) or the Metropolitan Stock Exchange.

Here is the list of Registered Stock Brokers in Currency Derivative Segment (link).

If you use any unauthorised trading platforms to trade in forex or using any other mode which is not authorised in India, then it will be a punishable offence.

As per reports, the Enforcement Directorate (ED) has frozen the bank account balance of OctaFX and its related entities to the tune of Rs 21.14 crore in the case of Illegal Online Forex Trading through international brokers under the Foreign Exchange Management Act (FEMA).

You can file a complaint against unauthorised electronic trading platforms (ETPs) for forex transactions on the National Cyber Crime Reporting Portal (https://cybercrime.gov.in). You can also file a complaint with the Enforcement Directorate (ed-del-rev@nic.in) and respective police authorities of States/UTs.

Frequently Asked Questions-FAQs

How to check RBI approved authorised dealers?

You can check authorised status online on RBI website to know who is approved and whose licence is cancelled.

Here is the link

Link to check the list of full fledged money changers.

List of full fledged money changers where Licence is cancelled.

What are currency derivatives?

Similar to stock futures and options (F&O), currency derivatives are F&O contracts traded on exchanges like NSE and BSE.

Future and Options are financial derivatives which allow a trader to speculate on the price movements of an underlying asset without actually owning it. In India, we have future contracts and options to trade for crude oil, stocks, nifty, bank nifty, natural gas, gold, silver, currencies and many other commodities.

A future contract obligates the buyer to buy an underlying asset, while the seller must deliver it at a predetermined price and date.

Whereas in option contracts, the buyer has rights but not the obligation to buy or sell the underlying asset at a predetermined price and date, while the seller must honour the contract if the buyer chooses to exercise it.

Here is the list of registered stock brokers in currency derivative segment (link).

What is the lot size in currency derivatives in NSE?

Lot size in currency contracts on the NSE represents the standardised quantity of currency units that can be traded within a single contract.

In simpler terms, it represents a minimum amount of a specific security eligible for trading in a single transaction.

You can find lot size details on NSE here (link).

What is the best currency pair to trade?

Based on volume and liquidity, major currency pairs includes followings;

- EUR/USD – the euro vs the US dollar

- USD/JPY – the US dollar versus the Japanese yen

- GBP/USD – British pound sterling versus the US dollar

- USD/CHF – the US dollar versus the Swiss franc

- AUD/USD – the Australian dollar versus the US dollar

- USD/CAD – the US dollar versus the Canadian dollar

Cross currency trading means a currency pair or transaction that does not involve the U.S. Dollar or home currency.

What is pip?

Point in price (pip) means the smallest movement or change in the valuations of the currency pair.

For example, assume that the USD/INR rate is 82.7502 today and it becomes 82.7501 on the next trading day. In this case, the point in price (pip) would be 0.0001.

What is an Electronic Trading Platform (ETP)?

Electronic Trading Platform (ETP) is a system where instruments like securities, money market instruments, foreign exchange instruments, derivatives, etc. are contracted.

No one can operate ETP in India without prior approval of the RBI.

You can check the authorisation status of any person / ETP from the list here published by RBI.

Who is a famous currency trader?

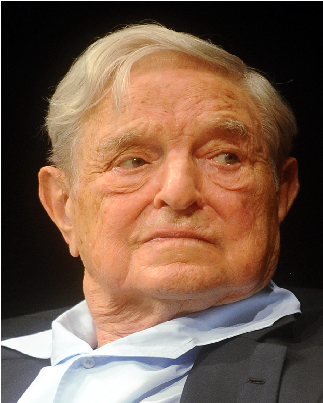

George Soros

George Soros is a Hungarian-American billionaire investor. As of October 2023, he had a net worth of US$6.7 billion. Soros is known as “The Man Who Broke the Bank of England” as a result of his short sale of US$10 billion worth of pounds sterling, which made him a profit of $1 billion, during the 1992 Black Wednesday UK currency crisis. (source: WIKIPEDIA)

Thanks for reading our article on What is Forex Trading: Is it legal to trade currency pairs in India?.

You are requested to go through the following links to understand how forex transactions and FX trading is regulated in India.

List of authorised Electronic Trading Platforms (ETPs)

FAQs issued by RBI on Foreign Exchange (Forex) Transactions (link)

RBI’s Master Circular on Risk Management and Inter-Bank Dealings (link)

Disclaimer: In addition to the disclaimer below, please note, this article is not intended to provide investing or trading advice. Trading in the stock market and in other securities entails varying degrees of risk, and can result in loss of capital. Most investors and traders lose money. Readers seeking to engage in trading and/or investing should seek out extensive education on the topic and help of professionals.