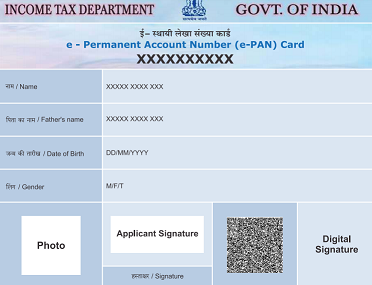

PAN stands for permanent account number. PAN is a 10 digit alphanumeric number issued by income tax department to the applicant who has submitted form 49B along with documents.

Also Read: How to get instant PAN online

You can apply for a PAN at any point of time. Once issued, it’s valid for your entire life.

However, you can not hold more than one income tax permanent account number or PAN at a time.

Here are top 20 reasons why you must have a income tax permanent account number.

- To obtain a credit or debit card.

- Payment for life insurance premium amount aggregating Rs 50,000 or more in a financial year.

- To file your annual income tax return or ITR.

- Cash deposit exceeding Rs 50,000 into a bank or post office account.

- For opening a term deposit in a bank or cooperative bank or post office or nidhi or NBFC exceeding Rs 50,000 or aggregating to more than Rs 5,00,000 during a financial year.

- Payment to hotels and restaurants in cash against a bill or bills at any one time for a amount exceeding Rs 50,000.

- To one a demat account.

- Payment in cash for an amount exceeding Rs 50,000 for a travel to foreign country or purchase of foreign currency.

- Sell or purchase of motor vehicle other than a two wheeler.

- Opening an account with a banking company or a co-operative bank. For basic saving account PAN not required.

- Payment of an amount exceeding Rs 50,000 to a mutual fund for purchase of units.

- Payment of an amount exceeding Rs 50,000 to Reserve Bank Of India for acquiring bonds.

- Sale or purchase of any immovable property for an amount exceeding Rs 10,00,000 or valued by stamp valuation authority referred to in section 50C of the act at an amount exceeding Rs 10 lakhs.

- Sale or purchase by any person of goods or services for an amount exceeding Rs 200000 per transaction.

- Payment for one or more pre-paid payment instruments to a banking company or co-operative bank or to any other company or institution when amount is more than Rs 50000 in a financial year.

- Payment of Rs 50000 in cash during any one day to purchase bank drafts or pay order or banker’s cheque from a bank or co-operative bank.

- To claim refund for tax deducted at sources.

- To submit form 15G/15H for non deduction of tax from interest income.

- To register a One Person Company, public or private limited company in India. In this case you need PAN of directors.

- Income exceeds basic exemption limit not chargeable to tax in India.

Penalty of Rs 10,000 can be levied for violation

In following cases, you may be required to pay a penalty of Rs 10,000 under section 272B of the Income tax act,1961.

- Holding more than one Permanent Account Number or PAN

- Knowingly quoting a wrong Permanent Account Number (PAN) in a document or transaction

- For not obtaining permanent account number, where its required to be obtained.

However, penalty under section 272B can not be imposed unless the person on whom the penalty is proposed has given an opportunity of being heard in the matter.

You can apply for a PAN both online or offline. To apply online, you can visit NSDL site. If you want to submit physical documents, then you can visit any TIN FC.