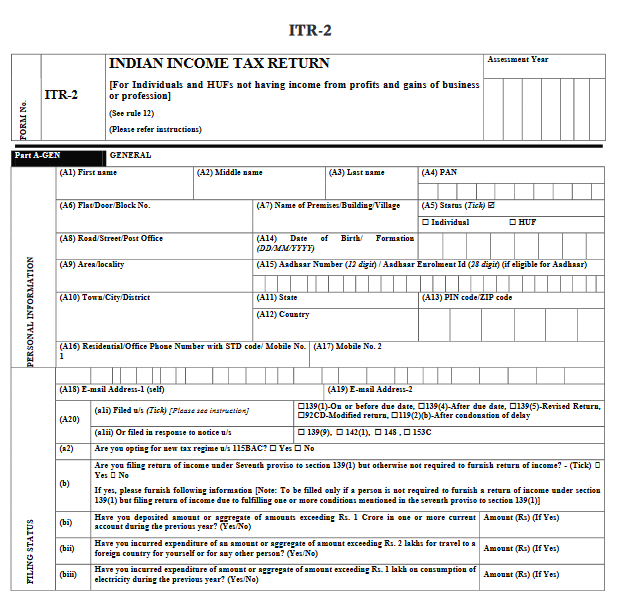

As per the current law, income tax return form ITR-2 is to be used when you are not eligible to file form ITR-1 and you don’t have income from business or profession.

For instance, suppose you are working as a director of a company in addition to getting salary income for the previous year 2023-24 (Assessment Year 2024-25), in this case ITR-1 is not applicable. You need to file form ITR-2 even if you don’t have any income other than salary.

If you are not a director but holding equity shares in a private limited company, then ITR-2 is for you. You can not file ITR-1.

If ITR-1 is not applicable and you have income under the head “Profits or gains of business or profession”, then go for ITR-3 as business income can not be filed by using form ITR-2.

What if you file ITR-1 even though it’s not applicable?

If you file ITR-1 but it’s not applicable, then your return of income can be treated as defective.

Don’t assume that the income tax department has no clues about your income and other details. In a digital world most of the financial transactions and details relevant for paying tax in India are tracked by the government. You are suggested to check form 26AS and AIS before filing your return of income.

AIS will give you a comprehensive view of your income and financial transactions for the financial year.

In case of a defective income tax return, you need to file your ITR again with correct details by selecting the right form.

When not to file Income tax return form ITR-2

As per tax laws, an individual or HUF is not required to file income tax return form when total income before allowing deductions under Chapter VI-A of the Income-tax Act, 1961, exceeds the maximum amount which is not chargeable to income tax. Most of the time this threshold limit is referred to as the basic exemption limit in income tax.

The maximum amount not chargeable to income-tax for the previous year 2023-24 (Assessment Year 2024-25), in case of different categories of individuals opting for old tax regime is as under:-

- Rs 2,50,000 in case of an individual who is below the age of 60 years or a Hindu Undivided Family (HUF).

- Rs 3,00,000 in case of an individual, being resident in India, who is of the age of 60 years or more at any time during the financial year but below the age of 80 years.

- Rs 5,00,000 in case of an individual, being resident in India, who is of the age of 80 years or more at any time during the financial year.

If you have opted to pay income tax as per the new tax regime under section 115BAC for the previous year 2023-24 (Assessment year 2024-25), then the limit is Rs 3,00,000 irrespective of your age.

In certain cases, you are required to file your income tax return irrespective of your total income for the financial year. For instance in following cases, you must file your income tax return even if you have zero income during the year;

- Deposit of amount or aggregates of amount exceeding Rs 1 crore in one or more current accounts;

- Incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or any other person;

- Incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity.

Frequently Asked Questions (FAQs)

When ITR-1 Form Should be used by a Salaried Individual?

Salaried individuals can use the ITR-1 form if they meet these conditions:

- Total income does not exceed ₹50 lakh.

- Income comes from salary, one house property, family pension, agricultural income (up to ₹5,000), and

- Income comes from other sources like interest from savings accounts and deposits, interest from income tax refunds, and family pension income

Salaried individuals cannot use ITR-1 if they are non-residents or have income from sources like capital gains or foreign income.

What Documents Are Needed for ITR-1?

You should have the following documents ready:

- Form 16

- House rent receipts (if applicable)

- Investment payment proofs

You don’t need to attach any documents when filing, but keep them in case the tax authorities ask for them later.

Who Can Use the ITR-2 Form?

A salaried person should file using the ITR-2 form if they:

- Are a company director

- Have investments in unlisted shares

- Have income from more than one house property, capital gains, or foreign income

- Own assets outside India

- Have total income exceeding ₹50 lakh

- Have agricultural income over ₹5,000

- Have capital gains from selling digital assets like cryptocurrencies

Is Verification of the Return Mandatory?

Yes, you must verify your ITR within 30 days of submission.

You can do this online using EVC (Electronic Verification Code) or DSC (Digital Signature Certificate).

Alternatively, you can send the ITR-V receipt via speed post to the Centralized Processing Centre (CPC) within the same time frame. It’s best to complete the verification online to avoid any postal issues.