An income tax refund is the amount of money returned to a taxpayer by the tax authorities when they have paid more tax throughout the year than they actually owe.

For salaried individuals, this type of situation arises when taxes are withheld from salary under section 192 or when they make advance tax on their estimated income, and the total payments exceed the taxpayer’s final tax liability after filing their tax return.

The refund represents the overpaid tax amount and is usually issued by cheque or direct deposit to the taxpayer’s bank account.

Any person, who can satisfy the assessing officer that tax paid by them or on their behalf exceeds the actual tax liability for a financial year, will be entitled for tax refund.

This means, you are eligible for an income tax refund if the amount of tax paid exceeds the actual tax liability for a previous year.

Here is how income tax refund is calculated:

Tax refund = (advance tax + self-assessment tax + tax collected at source + tax deducted at source + any other payment of tax) – actual tax liability as per return filed

Who can’t claim a tax refund in India?

In India, not everyone is eligible to claim a tax refund.

If your tax liability equals or is less than the taxes already deducted or paid, you cannot claim a refund. The refund only applies if the tax paid (through TDS, advance tax, etc.) is more than your final tax liability.

Here are some of the common situations where an individual may not be able to claim a tax refund.

- Taxpayers claimed deductions or exemptions for which they are not eligible.

- Taxpayer has not filed an income tax return.

- When the Income Tax Department is investigating your return for any reason such as suspicion of fraud, concealment of income, or mismatches in reported income.

- When taxpayers have any pending dues or outstanding liabilities for earlier years with the Income Tax Department. Typically it’s adjusted against the refund due.

- If the taxpayer’s PAN (Permanent Account Number) or other details in the tax return are incorrect, or if the tax department is unable to match details in ITR with your bank details, your refund might be rejected or delayed.

How to claim a tax refund?

Refunds can be claimed by filing an income tax return.

Before filing an income tax return, ensure that you have paid more tax (through TDS, advance tax, etc.) than your final tax liability, as a refund is only possible in such cases.

If you have opted for the old tax regime, check that all necessary deductions (like 80C, 80D, etc.) are claimed correctly and that your income tax return is accurate.

If you are eligible for refund, you can claim it by filing your income tax return in accordance with the provisions of section 139 of Income tax act, 1961.

Choose the correct ITR form based on your income type. For instance, ITR-1 is for salaried individuals and ITR-2 for salaried individuals with multiple income sources.

Before filing, ensure all details are accurate, including tax deducted at source (TDS), advance tax paid, and any eligible deductions.

Incorrect ITR form may be considered as a defective return by the tax authorities. In such a case, your refund will not be issued unless and until it’s not rectified.

After submitting the income tax return, e-verify it to complete the filing process.

After the return is filed and verified, the Income Tax Department will process your return. This can take a few weeks to a couple of months depending on the volume of returns.

If your return is processed and a refund is due, the Income Tax Department will initiate the refund. The refund amount will be credited directly to your bank account, which is linked to your PAN.

If the taxpayer has provided Bank Account number, IFSC code of bank branch and correct communication address, then the department will credit tax refund directly to the bank account. Otherwise, a paper cheque is issued to the given address of the taxpayer.

Delay in getting tax refund

Most often taxpayers ask why are tax refunds taking so long?

There can be many reasons for delay in income tax refund.

If the delay is from the department, you can follow-up with the CPC office.

However in many cases the delay is due to certain factors from the taxpayer’s side.

Here are five things to do if you want income tax refund fast;

- File your income tax return as early as possible as the refund will be processed after filing your ITR. Delay in filing tax returns will delay the process.

- File the correct ITR form applicable to you.

- Cross check form 26AS, TDS certificates like Form 16 and 16A with your claim in the ITR. Department will delay the process in case of any mismatch. In case of any incorrect tax credit, do not claim that amount as refund or else the department might issue a demand notice.

- Provide your mobile number, e-mail ID, bank account details correctly along with all other information in the ITR. In case of multiple bank accounts, in ITR, choose the one to which you want to receive the refund.

Track your refund status regularly (link). You can also check refund paid status in the tax credit statement in form 26AS or in AIS.

If your refund is delayed beyond the expected time, you can raise a grievance on the Income Tax e-filing portal or contact the Income Tax Department’s customer service.

Interest on tax refund

In India, interest on income tax refunds is provided under Section 244A of the Income Tax Act. If the Income Tax Department delays your refund beyond the prescribed period, you are entitled to receive interest on the amount of the refund.

The interest rate on the refund is 0.5% per month, as per Section 244A.

Any fraction of a month shall be deemed to be a full month and interest shall be calculated accordingly.

The period for calculation of interest is based on filing of return of income and mode of tax payment.

Where refund is out of any tax deducted or paid by way of TDS or TCS or advance tax, interest shall be calculated for the following periods;

- If return of income is filed on or before the due date of filing, then interest has to be calculated for the period starting from 1st April of the assessment year to the date on which the refund is granted.

- Where return of income is not filed on or before the due date, interest has to be calculated from the date of furnishing return of income to the date on which refund is granted.

Where refund is out of any self-assessment tax paid under section 140A, period has to be calculated from date of furnishing return or payment of tax whichever is later to the date on which refund is granted.

No interest shall be payable if the amount to be refunded is less than 10% of the tax determined under section 143(1) or on regular assessment.

For the purpose of computing interest, the income tax shall be rounded off to the nearest multiple of Rs 100 and for this purpose any fraction of Rs 100 shall be ignored.

Please remember, Interest on refund is taxable, and it is added to your total income for the year. You need to include it in your return for the relevant assessment year, and it will be taxed as other income.

Also Read: How to choose the right Return of income for filing

How to check refund status online

To check the income tax refund status online in India, you can follow these simple steps:

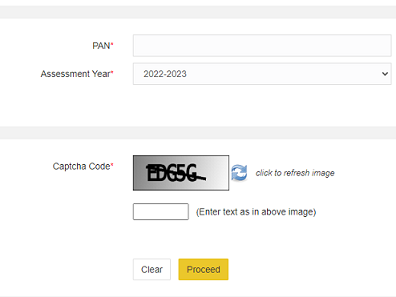

- Go to NSDL Site’s refund status page.

- Down below the screen you will have two fields to enter. In the first place you are required to enter the permanent account number of the person for whom you want to see the status online.

- After entering the PAN or permanent account number, select the assessment year for which you have applied for a refund.

- Click on proceed button

Now you will be displayed with the status i.e. the mode of payment, reference number, date of refund and status with remarks.

Please remember, you are required to type the PAN number in capital letters. If you type in small letters, then it will give you an error message like “invalid pan”.

If no results are displayed for you, then your income tax refund has not yet been processed by the tax department. You may check after a week to know the exact status as it takes a week time to get updated.

There can be many reasons for denying income tax refund. In case of delay, you can raise a re-issue request online by which it will be re-issued to your bank account.

We have listed few possible reasons for your reference;

- Bank details such as account number and IFSC code are not correct.

- Mismatch between form 26AS and details filed in IT return.

- Details such as BSR code, date of payment and challan numbers are not filled up correctly in IT return.

- ITR V has not yet been received at CPC Bangalore office in case you haven’t e-verified or income tax return is not e-verified.

Can my refund get adjusted against outstanding demand payable?

Tax authorities can set off the amount to be refunded against the sum payable as refund. This means, if a refund is due to you, the tax authority might in lieu of payment of the refunds, set off the amount to be refunded against the sum payable.

Set off will be done after service of a proper notice under provisions of section 245 and giving proper opportunity of hearing.

Most refunds are issued within a few months of the date the taxpayer initially files a return. However there may be instances where a refund takes longer.

If it takes longer than 6 months, then look for the mistakes that you have made in your Income Tax Return.

In calculation of interest, the amount of tax, penalty or other sum in respect of which interest is to be calculated will be rounded off to the nearest multiple of Rs. 100 ignoring any fraction of Rs. 100. While calculating interest any fraction of a month shall be deemed to be a full month.

The set-off arising against the tax payable shall be done by using the details of outstanding tax demand if such demand or refund is greater than Rs. 5000.

Can a Person other than the Assessee Claim Refund of Tax?

Although only the assessee is entitled to claim refund, however, in the following cases the refund can be claimed by a person other than the assessee:

- where the income of one person is included in the total income of any other person under any provision of the Income-tax Act (section 60 to 64), the latter alone shall be entitled to a refund in respect of such income;

- if a person is unable to claim tax refund due to death, incapacity, insolvency, liquidation (by liquidator) or other cause, his legal representative or the trustee or guardian or receiver, as the case may be, shall be entitled to claim or receive such refund for the benefit of such person or his estate

If your income tax refund is pending for a long time then contact your assessing officer immediately. You can take professional help from a local chartered accountant or tax consultant to help you in this matter.